- Thunderbolt Wealth Snippets

- Posts

- Thunderbolt Wealth Tips

Thunderbolt Wealth Tips

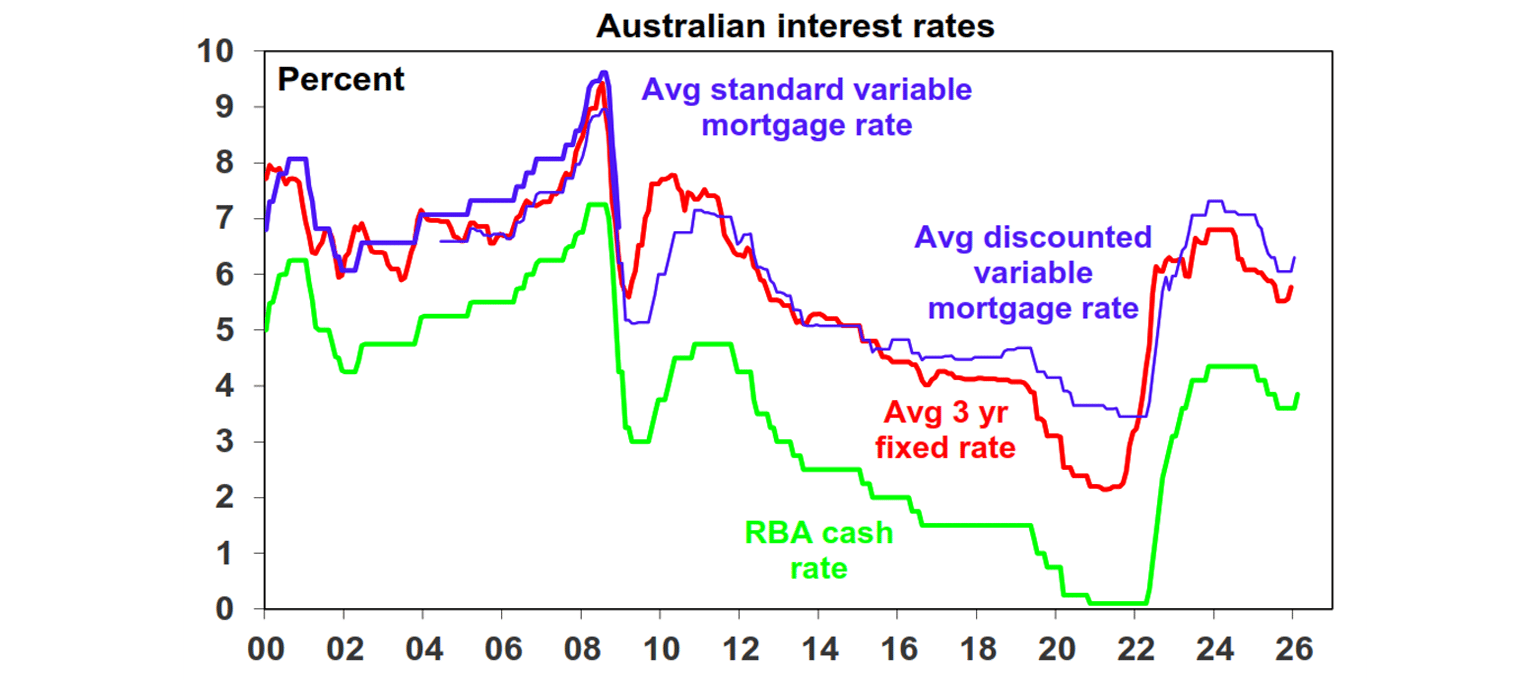

Rates are rising, more rises to come?

There is almost never just one rate rise.

I am sure you have seen this week’s rate rise all over the news. What a fast turnaround in the interest rate environment since November.

As someone who has worked in financial markets for 30 years, I know one thing, and that is, there is rarely ever 1 rate rise at a time.

So expect or at least plan for another one in the next 2-6 months.

How will this affect you and how should you be managing it?

Run the numbers with your mortgage at 1% higher. Can you manage? Where can you cut expenses or increase income? If not, lets chat about your options.

Do you have any expensive consumer things not being used right now? a tinny, a camper trailer, an e-Bike? Get it on marketplace and pay these funds into your offset account for a buffer.

Are you paying the best rate possible right now? If not, again lets chat. Stop giving the banks free money.

If you are looking to purchase:

Given the strength of the 5% first home buyer scheme, we are of the view that the market in this price bracket isn’t necessarily going to fall off a cliff, more of a steadying. Perhaps more days on the market for properties and perhaps a little softer at the margin. Above $1.5m (where the 5% scheme cuts out) in Sydney could be softer.

In Summary

Having invested in property for decades, we have alternatively seen rates in rising and falling cycles for months and years. Don’t lose sight of the big picture, and that is, the security that comes with your own home, fully paid off (eventually). Try to shut out the noise and keep focusing on the plan, but be adaptable.

Money Tips

After decades in Wealth Management, I’ve seen all the money mistakes, here are 10.

This week, click for Number 1.

That’s it for this week.

Keep showing up and keep cheering each other on — life is better when we support each other.

Reggie and the Thunderbolt Team